Welcome, founder!

In 5 minutes, you will know exactly how to use OpenVC like a pro.

Use the table of contents below to quickly find the answer you're looking for.

Table of Contents

Introduction to OpenVC (start here)

What is OpenVC and is it right for me?

OpenVC helps tech founders access 5,000+ investors around the world.

On OpenVC, you will find 5,000+ early-stage investors, including VCs, angels, accelerators, and family offices. Some of them accept cold outreach while others prefer warm intros.

OpenVC charges no success fee and no commissions. We offer a "Free forever" plan that allows any founder to raise funds, and we monetize via Premium features and a bit of advertising.

OpenVC also helps founders get better at fundraising with tutorials, templates, playbooks, and many other tools.

If you want to raise funds for your startup, OpenVC is where it's at!

How does OpenVC connect me with investors?

OpenVC connects you with investors in 3 different ways:

- Cold outreach : Thousands of investors accept cold outreach directly via OpenVC. When you see the button "Submit deck", click it and directly reach out to the investor.

- Warm intros : Plug your email, calendar, and LinkedIn into OpenVC, we will browse your network and find people who can connect you to your dream investors.

- Inbound requests : Add your startup to our deal flow page. Investors only see anonymized data like industry, country, revenue level... You can accept or reject every investor request and remain fully in control of your image.

In short, we help you maximize your options by finding the best access point to capital.

What fundraising tools are available on OpenVC?

When raising funds for your startup, you will need several tools. OpenVC brings you the most powerful software suite for that:

- Investor list: A list of 5,000+ investors, sorted by many exclusive filters and cleaned up weekly so it's always up-to-date.

- Fundraising CRM: A sleek and smart CRM that allows you to track store and track all your investor conversations, from first contact to closed deal.

- Deck tracking: Create unique deck links that you can share with investors anywhere. Track when your deck is opened and for how long.

Those tools are all natively integrated together: move an investor from the list to your CRM, shoot a deck link from the CRM, and track all the deck metrics directly inside the CRM. Smooth and efficient.

Lastly, OpenVC is collaborative. You can invite your cofounders or advisors to raise with you on OpenVC at no extra cost.

What if I've never raised funds before?

Most founders are first-time founders. They have never raised funds before.

Don't worry, we will show you how to do it step by step. We have templates, playbook, and tutorials to help you learn how to raise like a pro.

Just follow the checklist after signing up, you're in good hands.

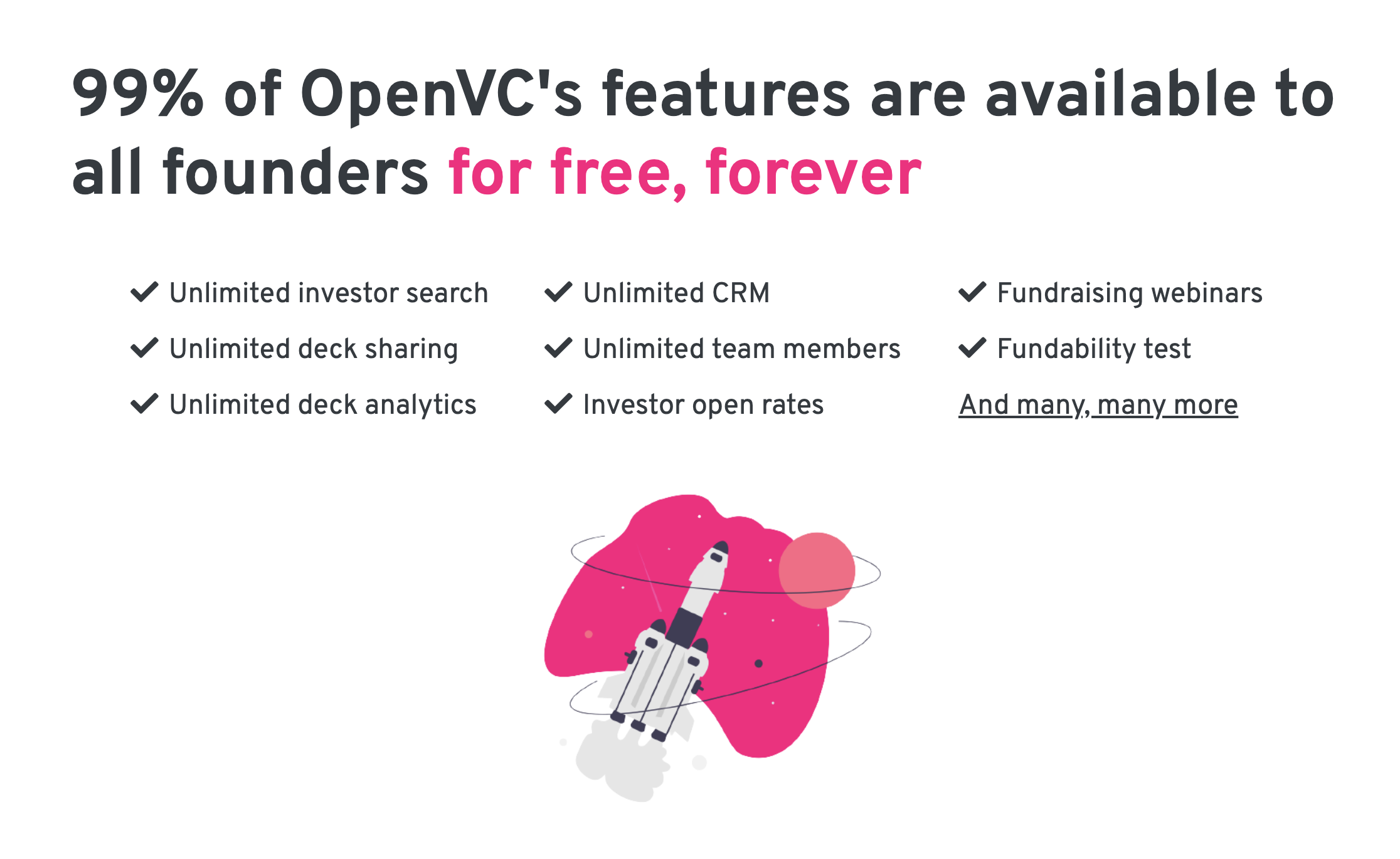

How much does OpenVC cost?

Most of OpenVC is free to use.

We don't charge a success fee, and we don't take equity in your company. You can raise $10M via OpenVC and never pay us one dollar.

The only product we sell is our OpenVC Membership for founders. It costs $99/month or just $288/year and unlocks advanced features, extra perks, warm intros, and allows you to reach out to more investors per day.

If you want to raise faster and support us, consider becoming an OpenVC Premium member.

I. Prepare your raise with OpenVC

Sign up as a founder

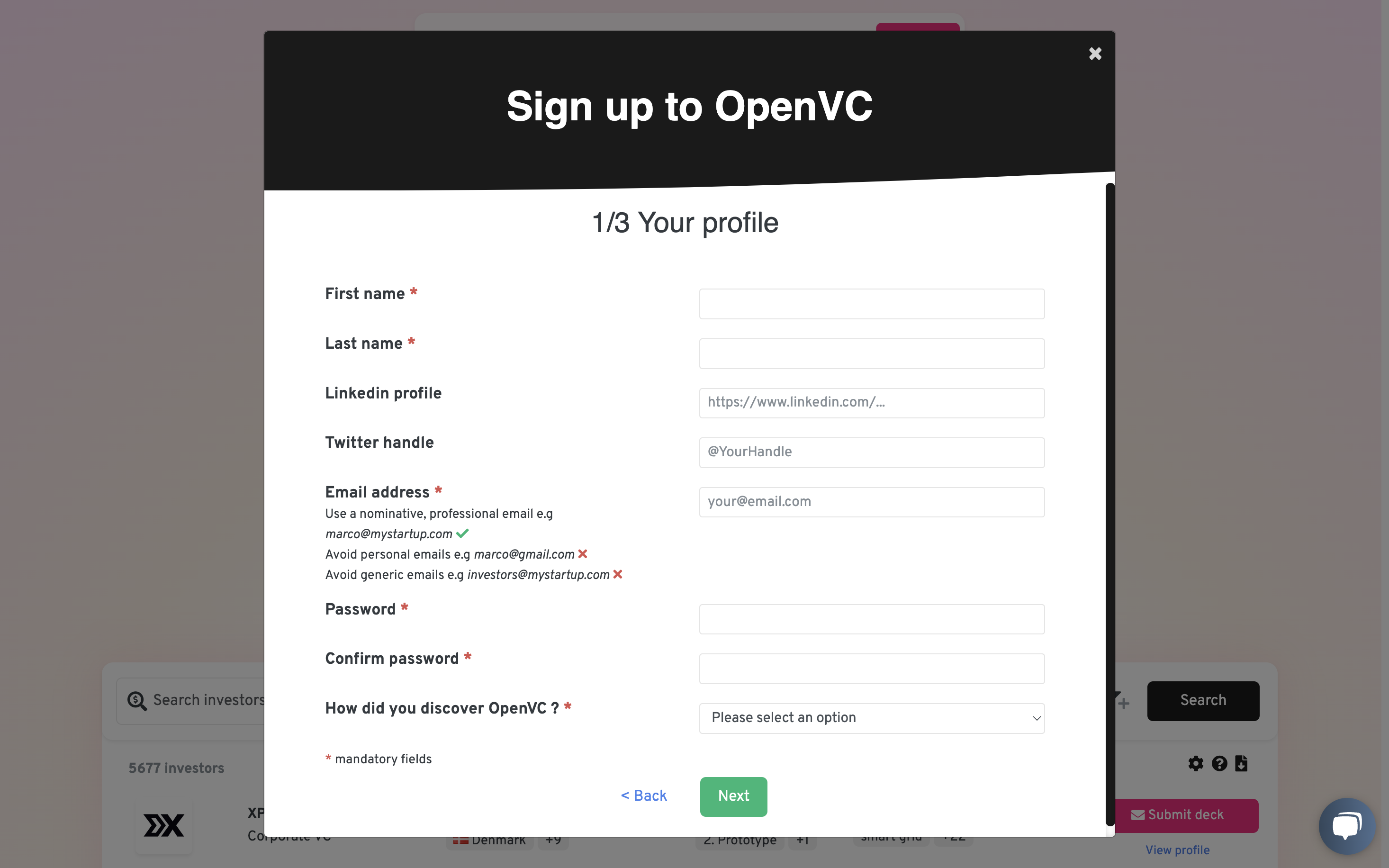

Go to OpenVC.app and click "Sign up", then "I'm a founder".

Fill in the first page with your personal information:

- OpenDeck.app: 1,500+ startup slides sorted by category. OpenFlow page, an anonymized deal page updated daily.

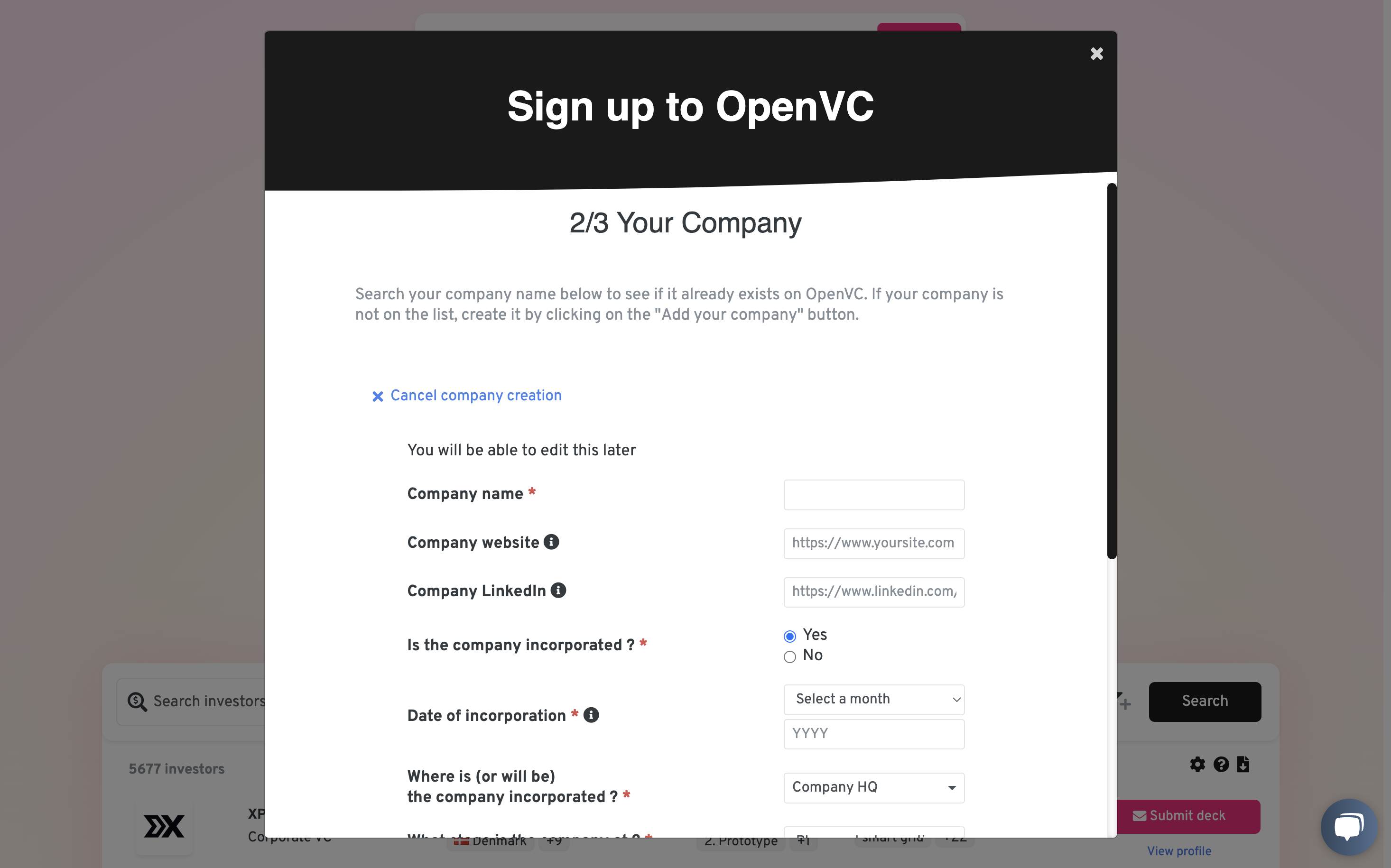

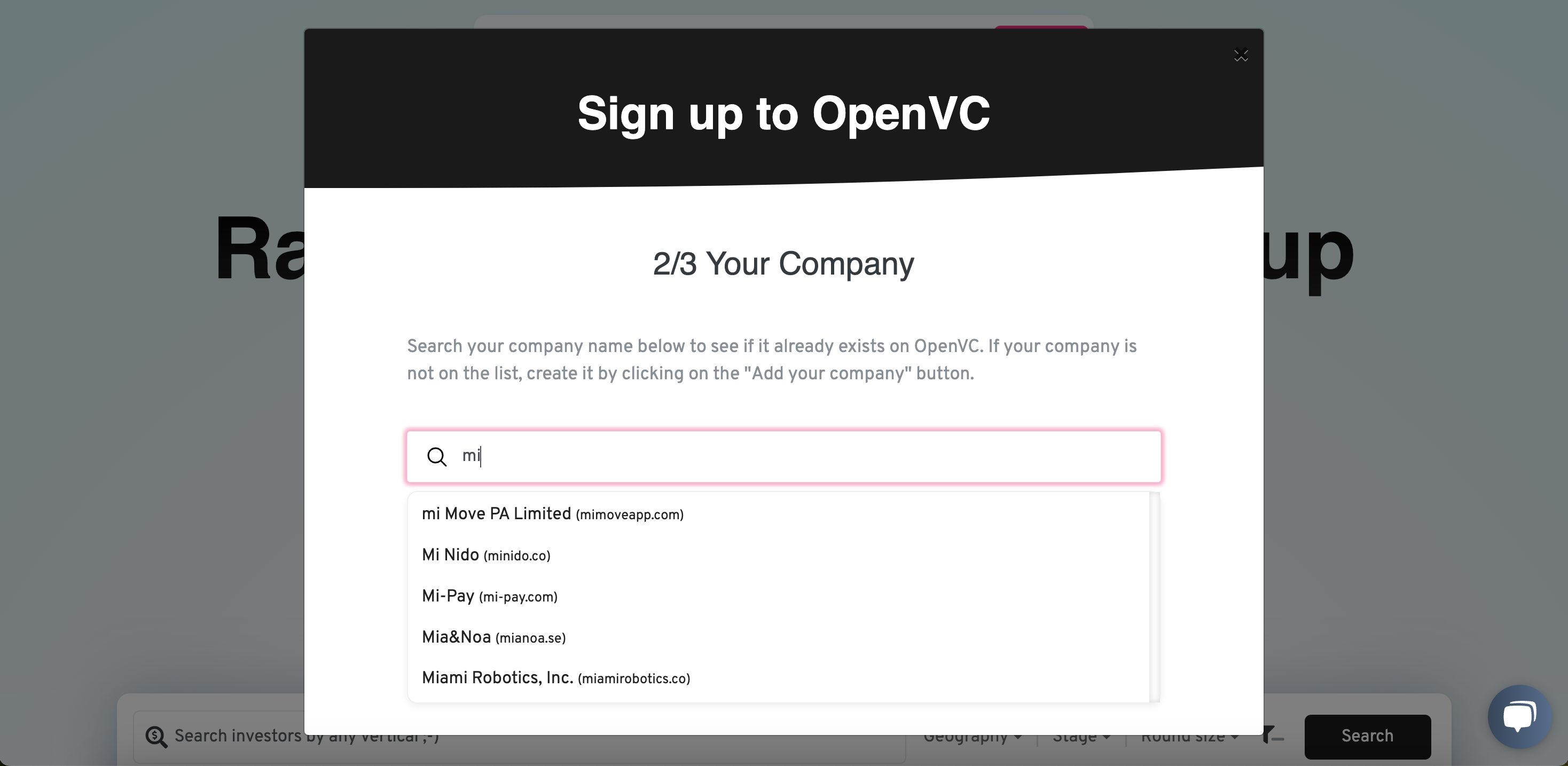

Then click "Next" and move on to your Company profile. Type in the name of your company and:

- OpenDeck.app: 1,500+ startup slides sorted by category. OpenFlow page, an anonymized deal page updated daily.

Once you sign up, you will receive a validation link to your email address. Click the link to activate your account and you're in!

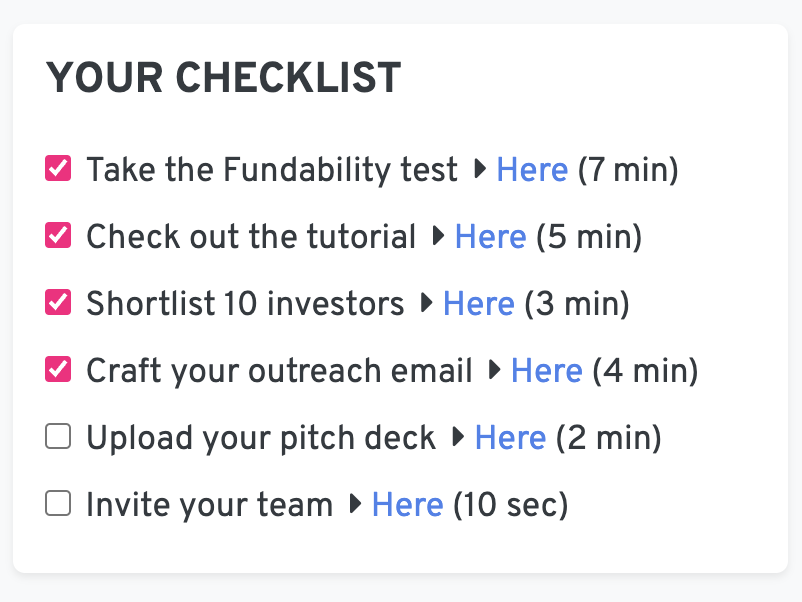

Complete the onboarding checklist

Make sure to complete the onboarding checklist after signing up. This will tremendously with every step of your raise forward.

Let's dive into each item.

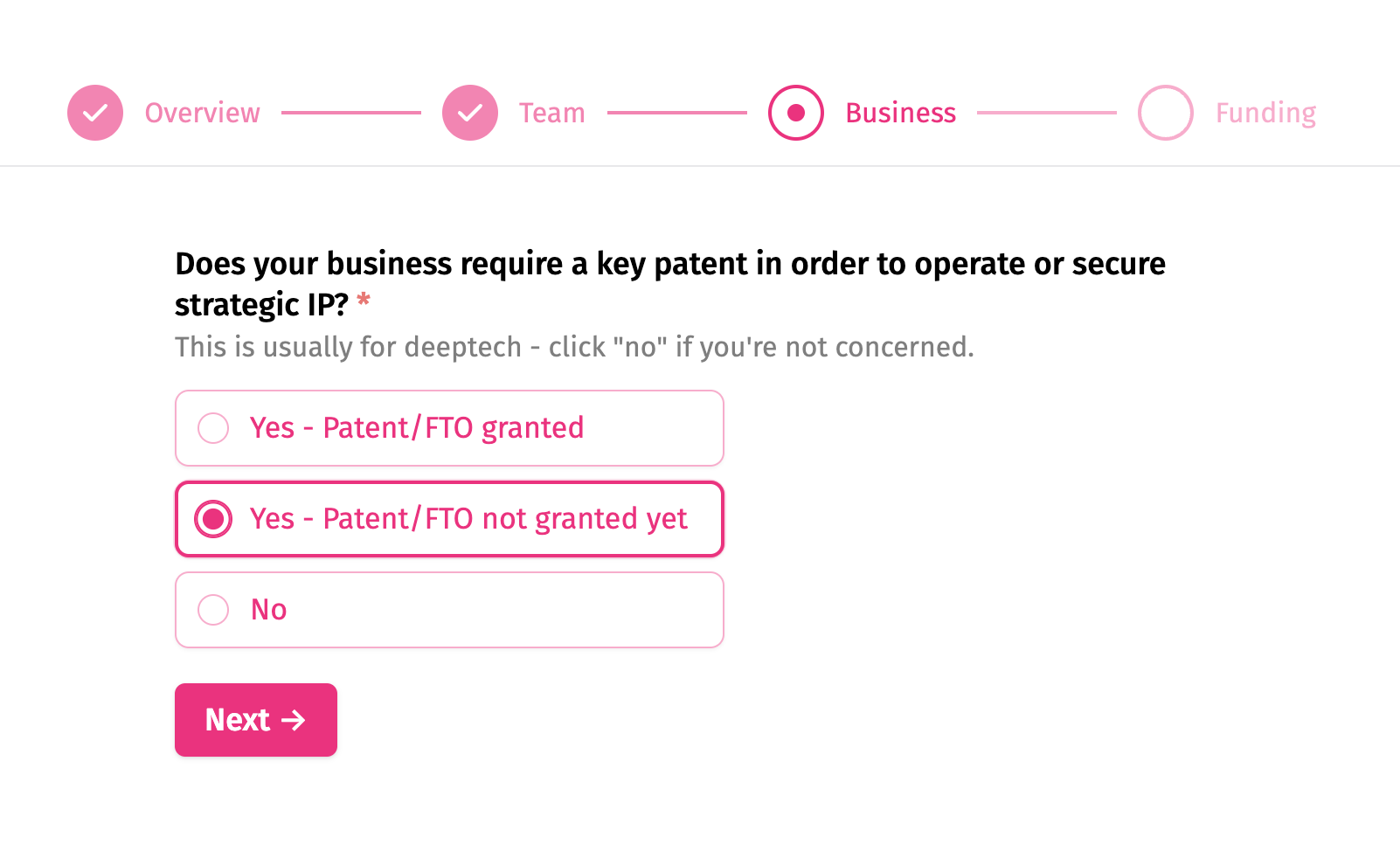

Take the Fundability test

The Fundability test is the starting point of your OpenVC experience.

Answer 30 questions and get a full assessment of your startup:

- 12 red flags: We test your startup on 12 red flags, so you can fix them before raising.

- Fundability score: Find out if you're in the top 50%, top 10% or top 1% of startups currently raising based on signals that investors love.

- Valuation range based on recent data from Carta and AngelList.

- Better investor targeting. We use your answers to refine your search results with additional keywords.

- Investor declined: The investor has clicked the "Pass for now" button on his OpenVC interface. They usually provide a short explanation with that.

Please note that your Fundability score is confidential and will never be shared with investors. You can re-take the Fundability test as often as you want.

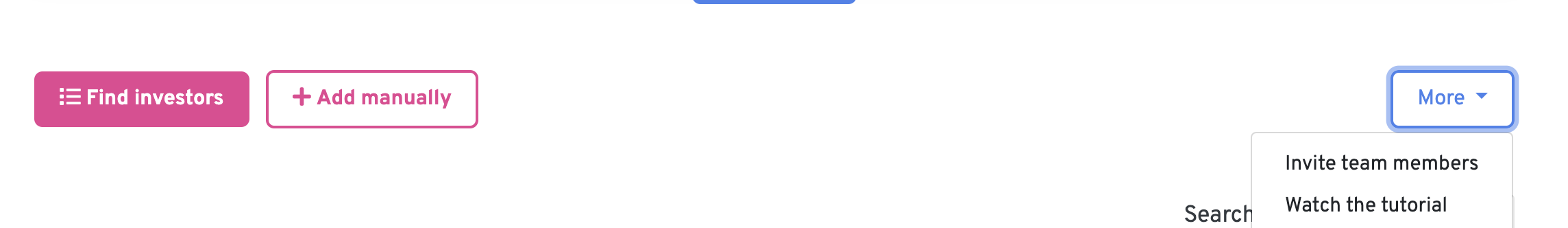

Invite your team members on OpenVC

OpenVC allows you to add an unlimited amount of team members, for free. Every team member can edit your startup profile, access your Fundraising CRM and reach out to investors on the behalf of your company.

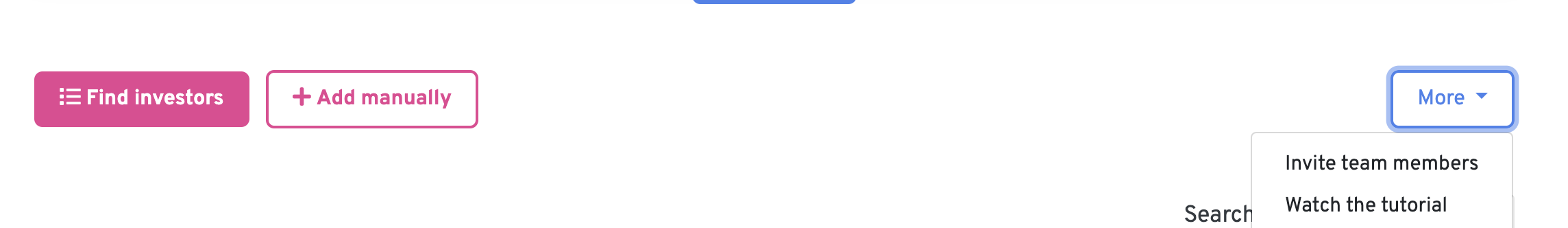

If you want to add your co-founders or team members to your OpenVC account, just log in to OpenVC, go to your CRM, click "More" and "Invite team members".

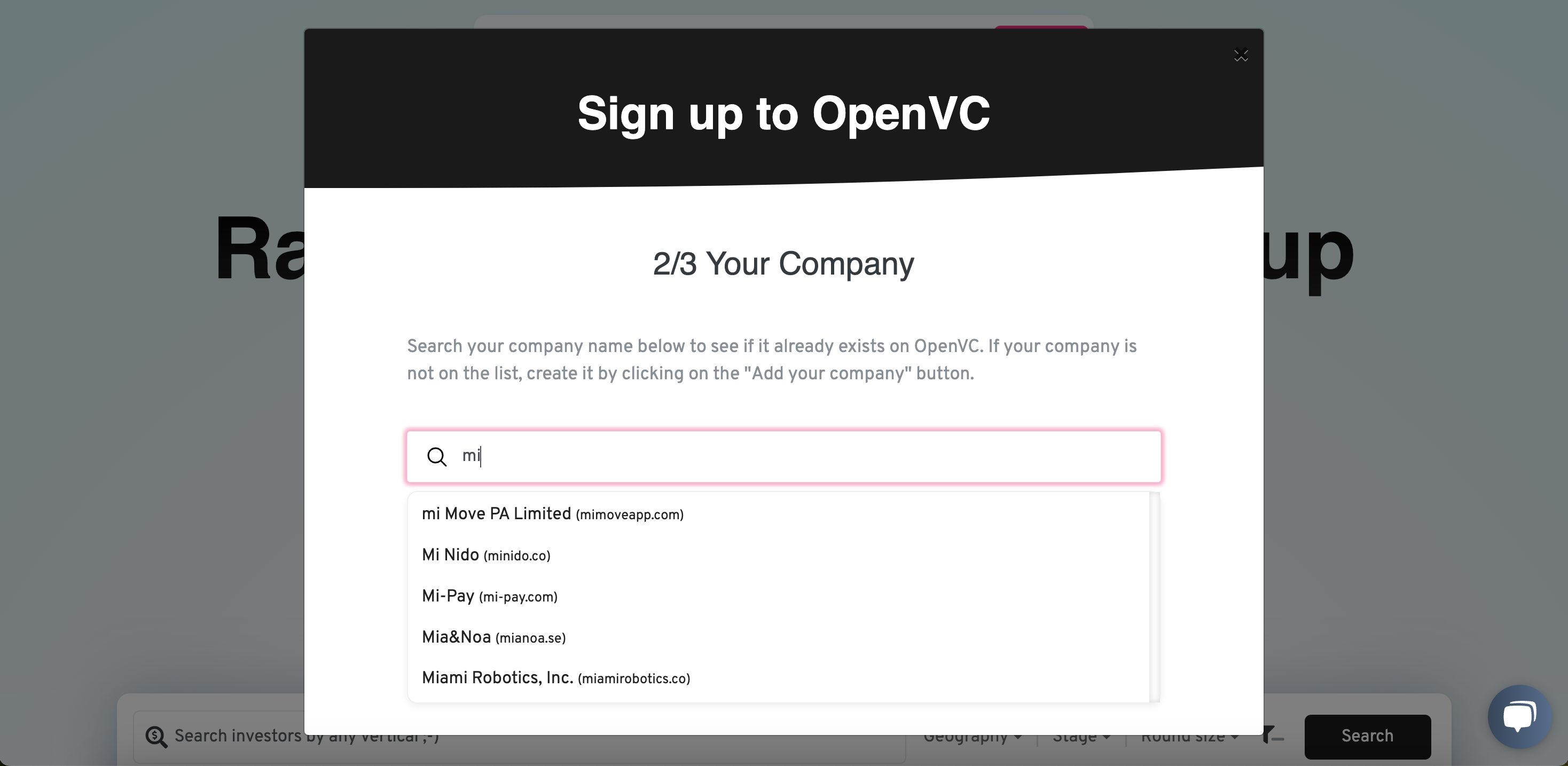

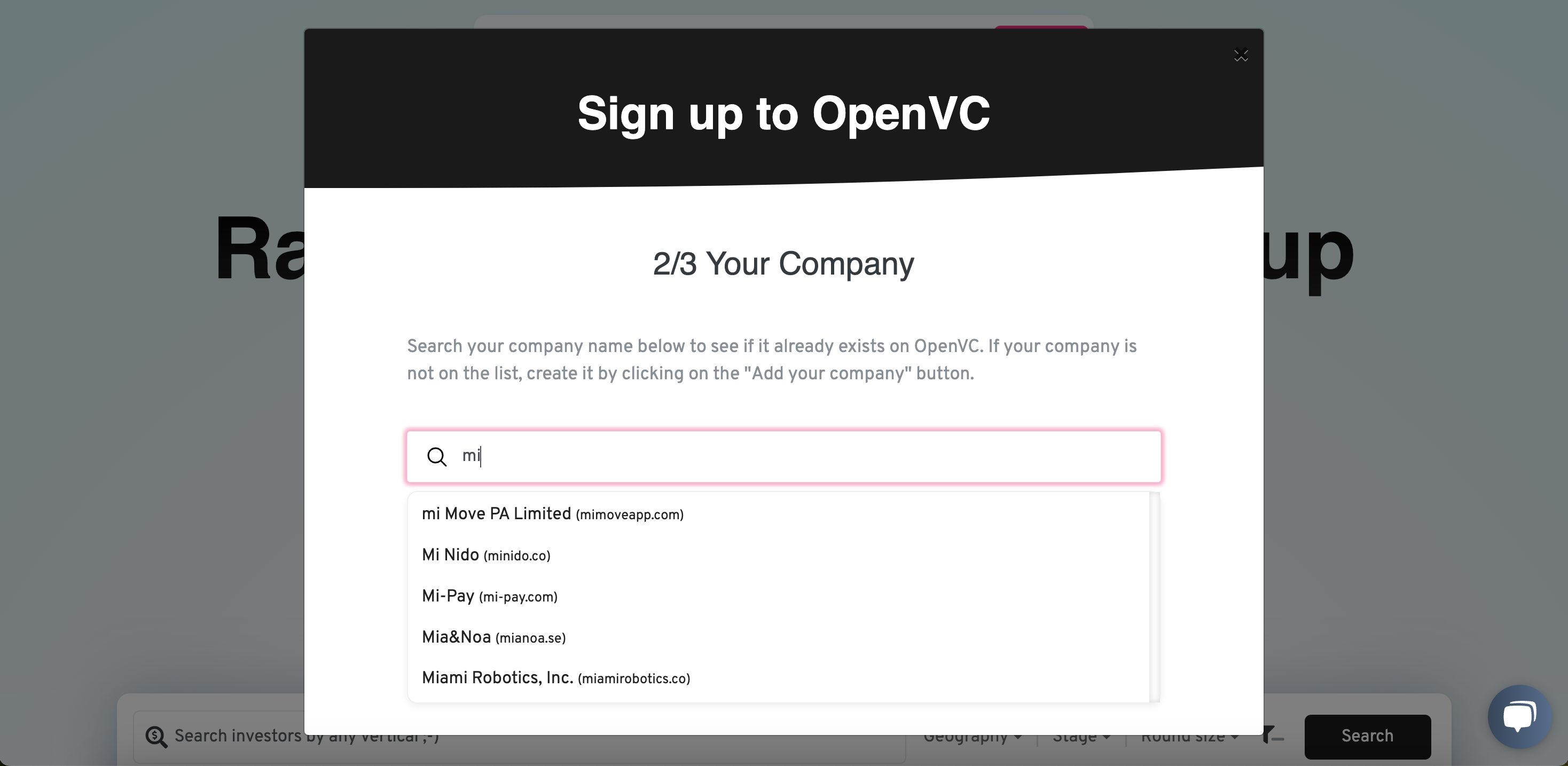

Your team members will receive an email inviting them to join OpenVC. When signing up, your team members need to select your company in the dropdown list (see image below). Then, you will receive an automated email with an approval link to be clicked.

That's it! Your team is now on OpenVC.

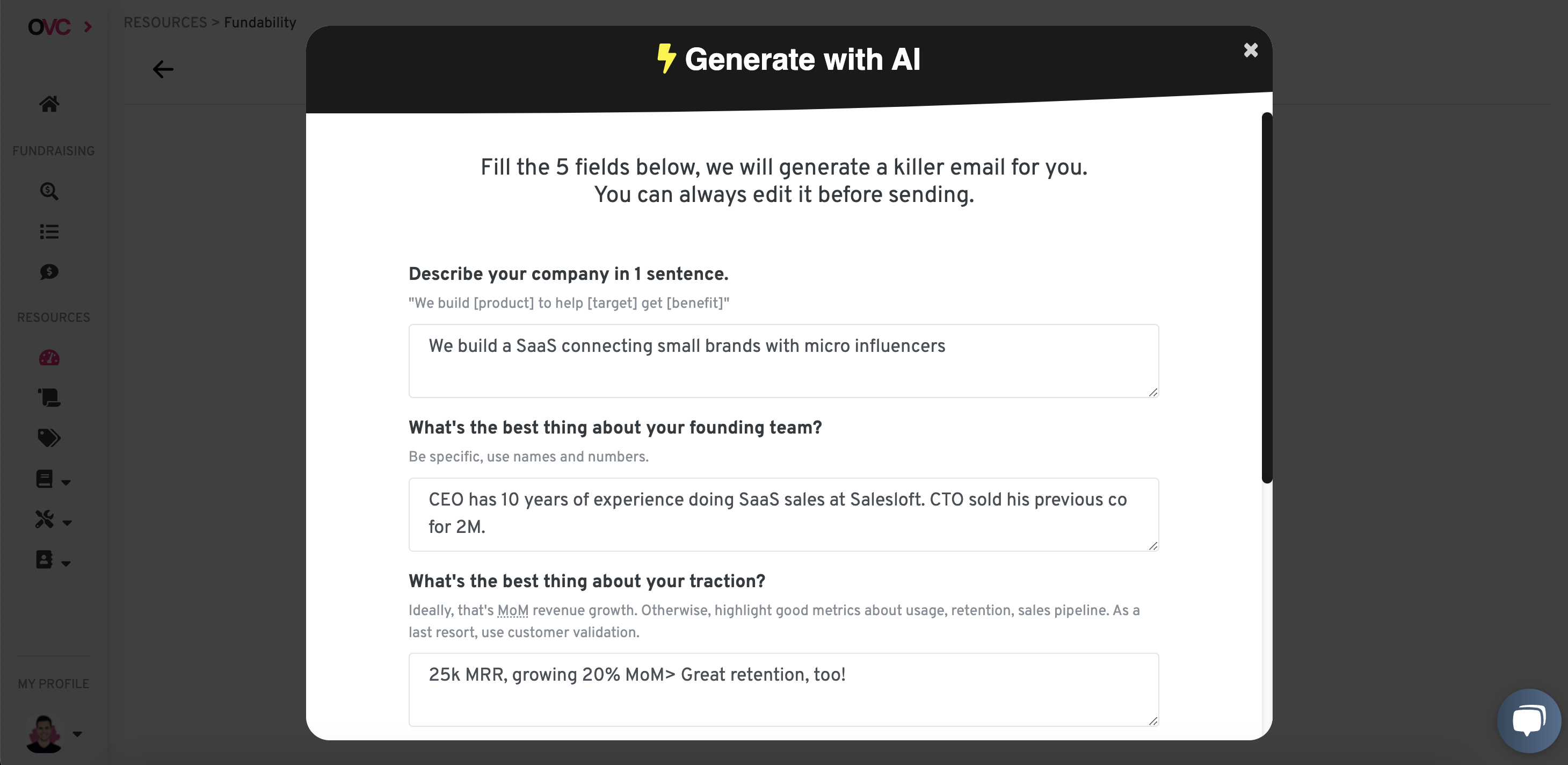

Craft your outreach email

You need a solid email to reach out to investors.

This used to be painful process, but AI made it much simpler.

Just follow the indicated steps to generate a solid email and save it as a template. You can always edit it before sending.

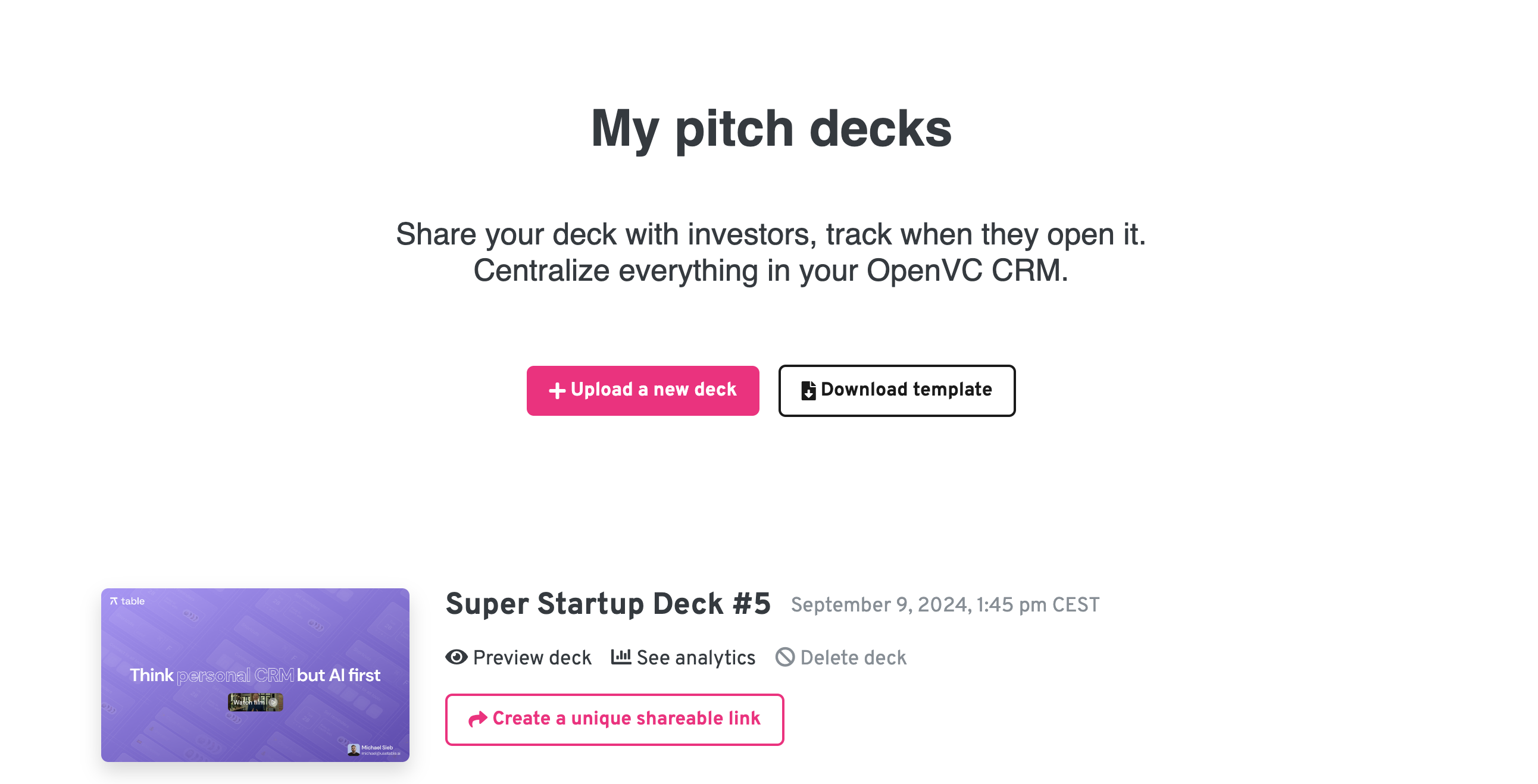

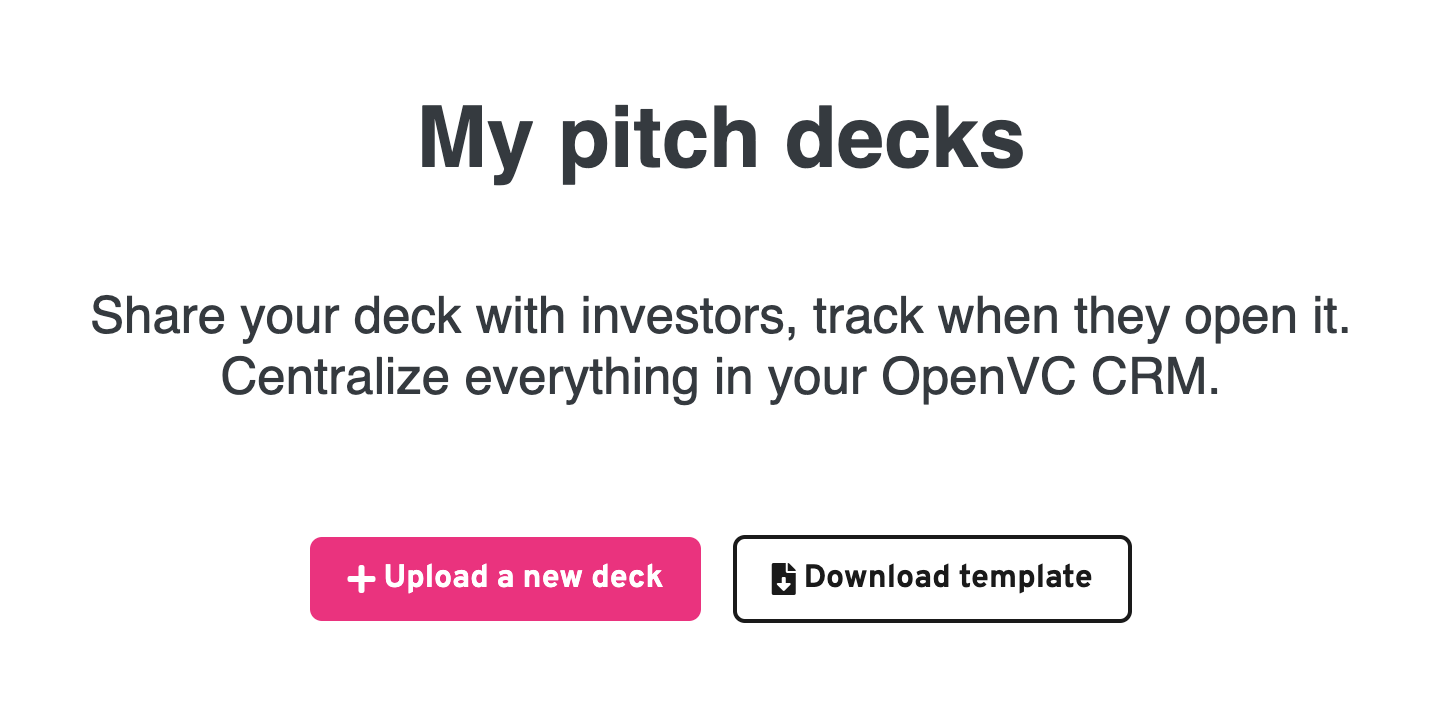

Upload your pitch deck

Your pitch deck is a key fundraising material.

Upload your deck on OpenVC and you'll be ready to generate unlimited deck links (with tracking) for every investor in an instant.

Pro tip: If your PDF is over 10Mb, use Small PDF to compress it first.

IMPORTANT: whitelist OpenVC with your email client

We will send you investor replies via the email address [email protected].

Therefore, you must make sure this address is whitelisted with your email client.

It takes less than 5 minutes. See how to whitelist OpenVC here.

II. Find the right investors for your startup

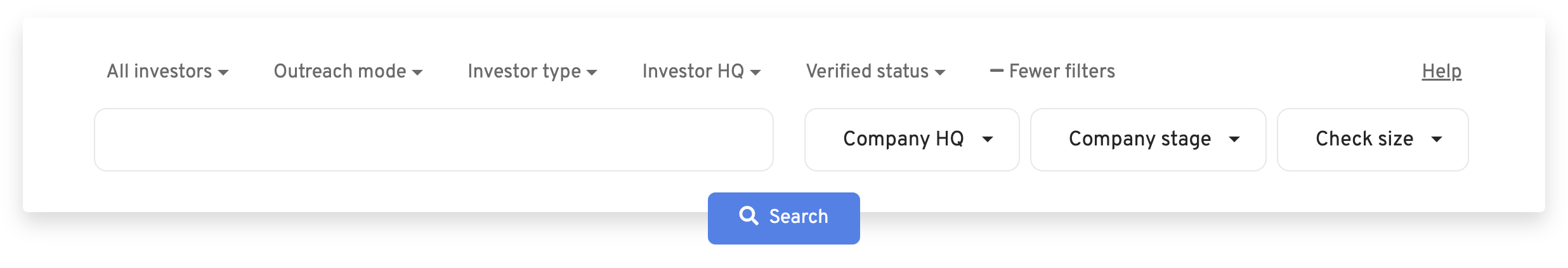

Use filters to find the right investors for you

Targeting the right investors is key to raising funds successfully.

OpenVC helps you target the right investors with multiple filters:

- Verticals: These are keywords that relate to the themes of investment such as fintech, SaaS, ecommerce, female founders, sustainability, etc. Type in anything and use the dropdown list to get relevant suggestions. The more keywords, the more accurate.

- Company HQ: This is your country where your company is incorporated. It does matter. Many investors will invest in US-based companies while very few will invest in Cuba or Iran. Just enter one value for the most accurate results.

- Company stage: Investors usually talk about funding rounds, such as "seed" or "Series A". However, these terms are often blurry. At OpenVC, we would rather think in terms of the company stage: idea, prototype, early revenue, scaling, growth, and pre-IPO.

- Investor interested: The investor has clicked the "I'm interested" button on his OpenVC interface. They usually book a meeting directly in your calendar (if you have included a calendar link) or reply to you via email.

OpenVC also provides Power Search for Premium users. These filters help you be more productive in your fundraising efforts.

- If you are starting a new startup

- Outreach mode: Some investors on OpenVC accept direct email. Others have an online form set up to receive deal flow. Others require warm intros only.

- Investor type: OpenVC lists down 10 types of investors ranging from angel investors to family offices. Use this filter to target the type you're most interested in.

- Outreach, where you can set up your email template and meeting link for investors page, an anonymized deal page updated daily.

- Ignored: If the investor doesn't reply to your deck within 15 days, we mark it as "Ignored".

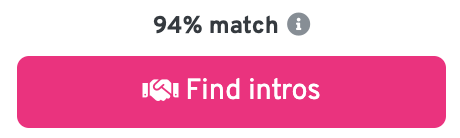

Once you run a search, results are ranked by match score. However, the matching score is not 100% reliable, so you should always read the Funding requirements before reaching out.

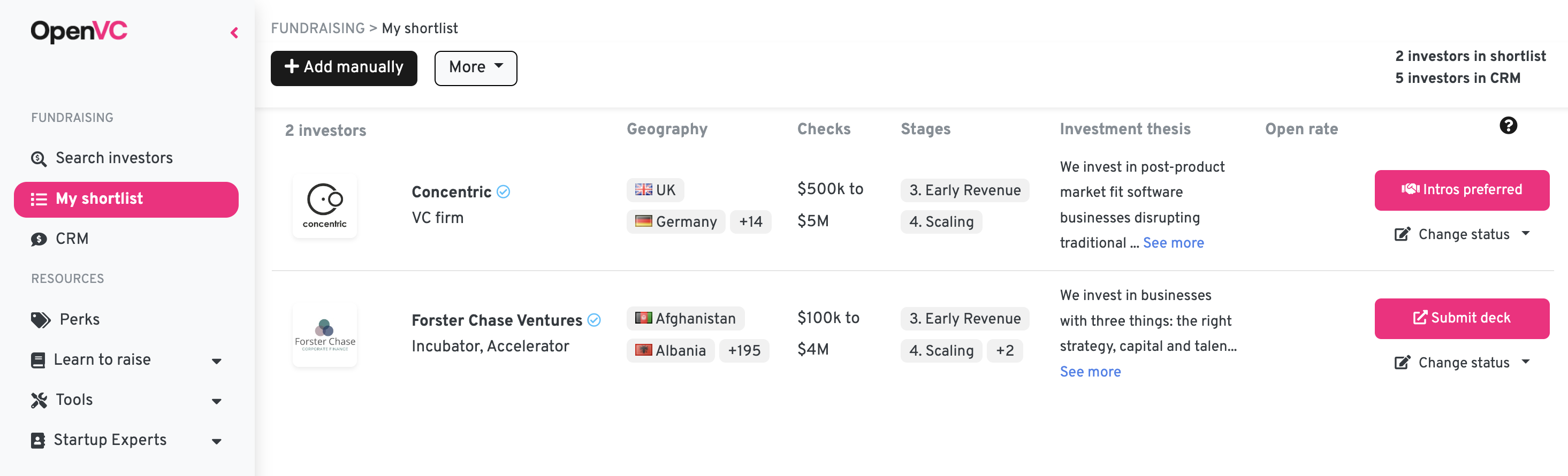

Build your investor shortlist on OpenVC

Before reaching out to investors, build a solid shortlist.

To do that, start from the "Search investors" menu and browse our list of 5,000+ investors. When you find an investor that seems like a good fit, just click "Add to Shortlist".

Rinse and repeat until you have gone through all the investors in our database. All your shortlisted investors will be waiting for you in the "My shortlist" menu.

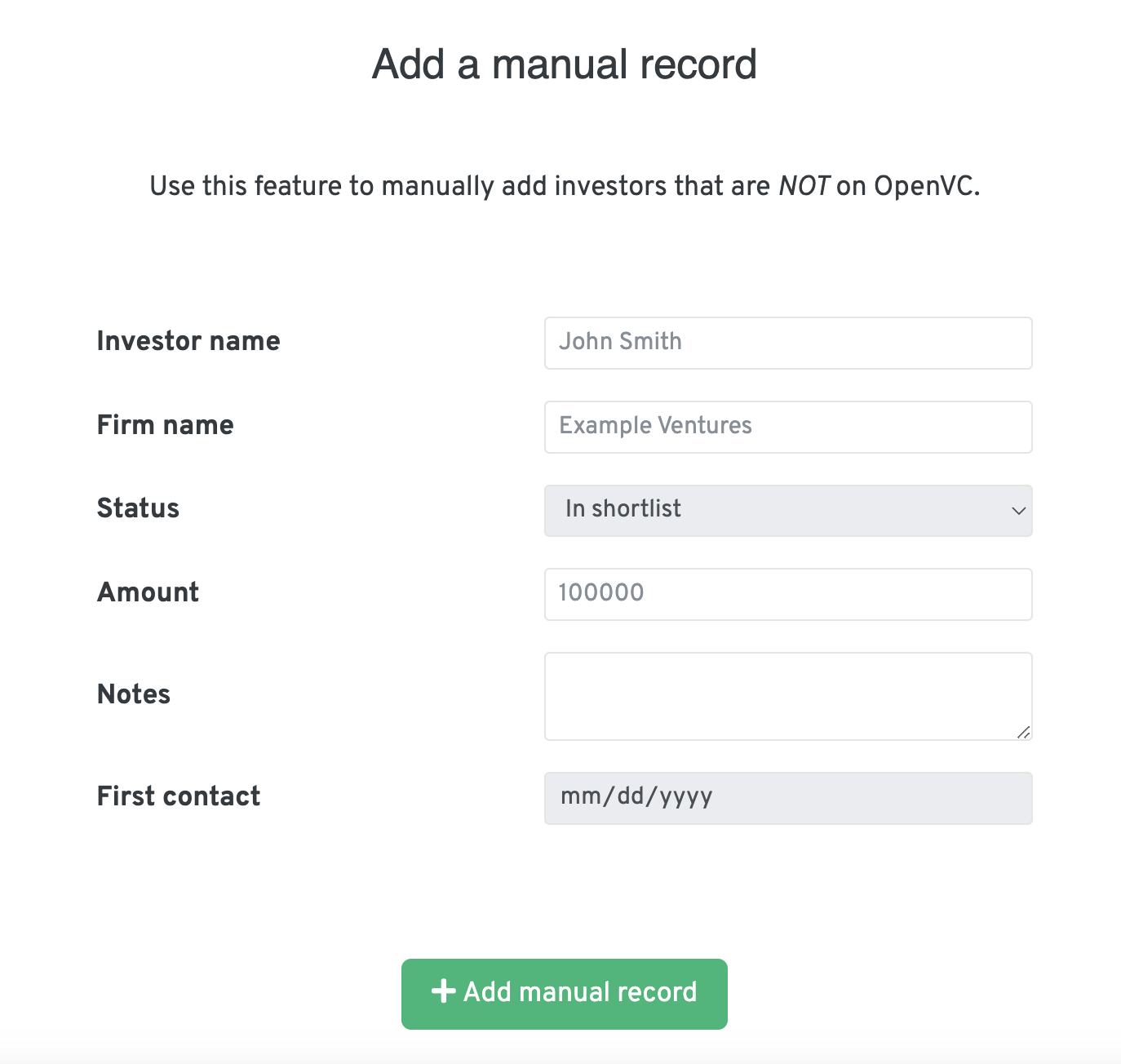

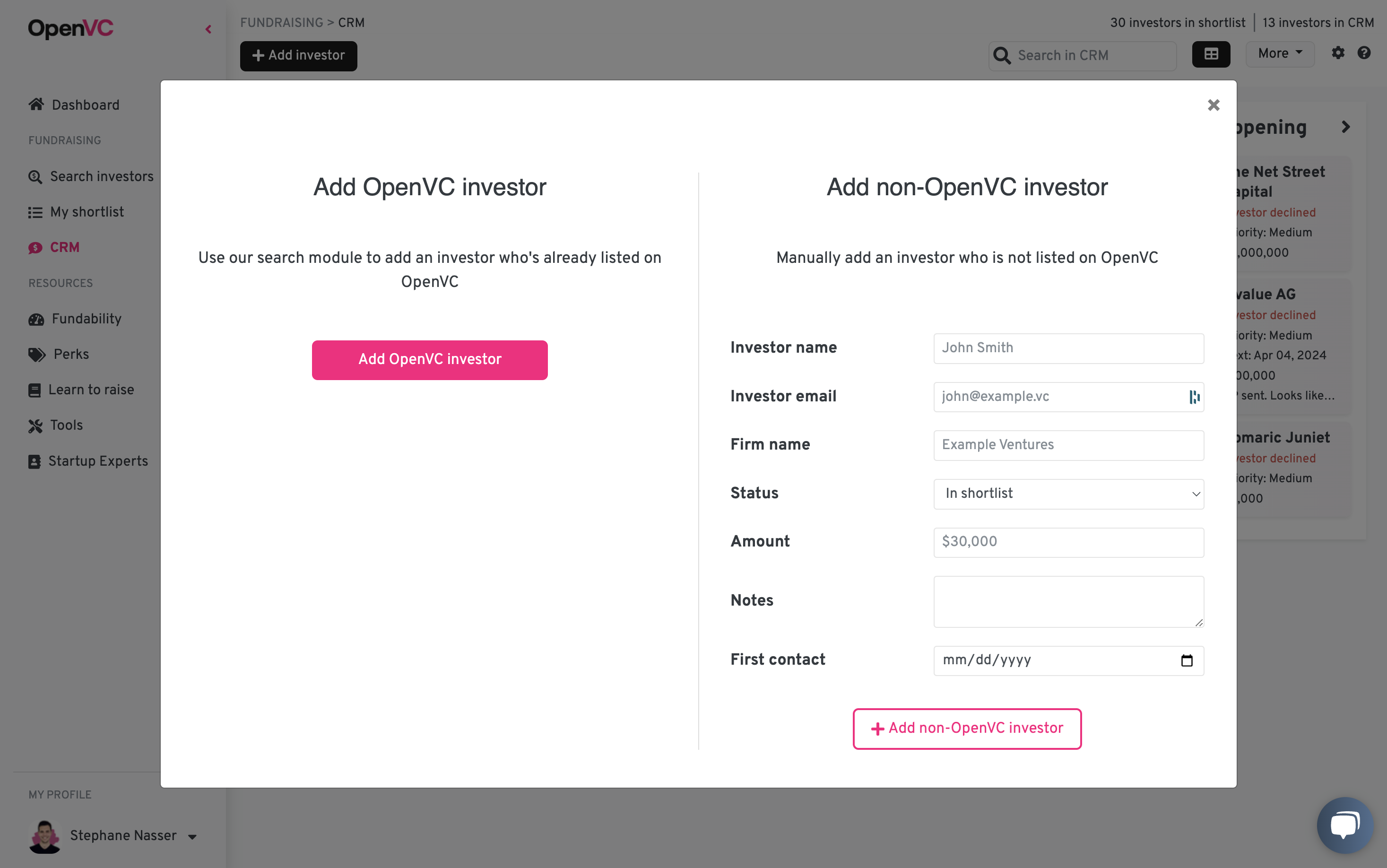

You can also manually add investors that are NOT on OpenVC. Just click the button "Add manually" and fill the fields.

Just like that, you can centralize 100% of your investor shortlist in one place, ready to take action.

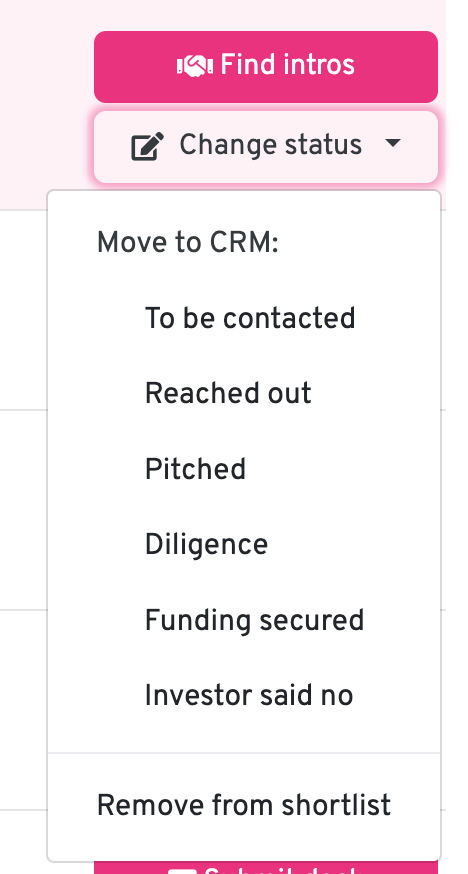

Think of your Shortlist as a gateway between Search results and your CRM.

From the Shortlist, you can manually move the investor to the CRM. In some cases, you can also "submit deck" directly from the shortlist, and the investor is automatically sent to the CRM. Easy peasy!

An investor is "Submit your deck later". What does it mean?

When investors receive too much deal flow in the past 7 days, the "Submit deck" is temporarily disabled and a warning message is displayed. Just try again in a few days.

An investor is "verified". What does it mean?

Verified investors have a blue checkmark next to their name. This means that they signed up themselves to OpenVC, so the data provided is likely extremely accurate.

By opposition, when the data comes from a third-party source, it is marked as non-verified.

Investors are verified based on email address and public information. However, OpenVC does not perform any KYC/AML verification.

We strive to provide accurate, fresh data, but you might encounter occasional errors. In any case, you should do your own due diligence on investors before sharing critical information or signing documents.

OpenVC is not liable for any damage that may arise from your interactions with other OpenVC users. Be smart, use common sense.

An investor profile says "Intro preferred". What should I do?

At OpenVC, we believe in letting people choose what works for them.

Some investors only accept intros. They are marked as "intro preferred". If you click their link, you will be directed to their LinkedIn page and may try to find a mutual connection (or message them directly via LinkedIn).

It can be frustrating, but at least, you know that these investors exist and what they invest in.

Other investors accept deal flow via an online form, such as Typeform or Google Forms. Just click the "Submit deck" button and follow the instructions.

Obviously, we're working hard to make as many investors accept direct cold emails via OpenVC. Keep reading to learn how to reach out to those open investors.

III. Access investors via intros, outreach, and inbound

Warm intros via OpenVC

Some investors don't accept cold outreach. In that case, we help you find people in your network who can introduce you to those investors.

First, upgrade to OpenVC Premium. Then click "Find intros" and plug your email, you calendar, and your LinkedIn account. You can even plug multiple emails, like your professional and personal addresses. Wait 2 to 8 hours until your whole network is analyzed - you'll get an email notification.

That's it! Now, click "Find intro" on any investor and we'll show you potential connectors. You can even see how people are connected, such as a joint employer or a co-investment in a startup.

This is a powerful feature. Keep in mind results depend on the extent of your existing network, though. Your data is processed by our partner Village, ensuring it's always private and secure. Contact us at [email protected] if you have questions regarding data privacy and security.

Cold outreach via OpenVC

Some investors have a button "Submit deck" on OpenVC.

This means that they signed up to OpenVC and opted in to receive deal flow via our platform. Just click the button, follow the instructions, and submit you deck.

Please note that every submission is screened by OpenVC. if your submission doesn't fit our guidelines, it will be rejected and we will provide some feedback so you can fix it and re-submit to that investor.

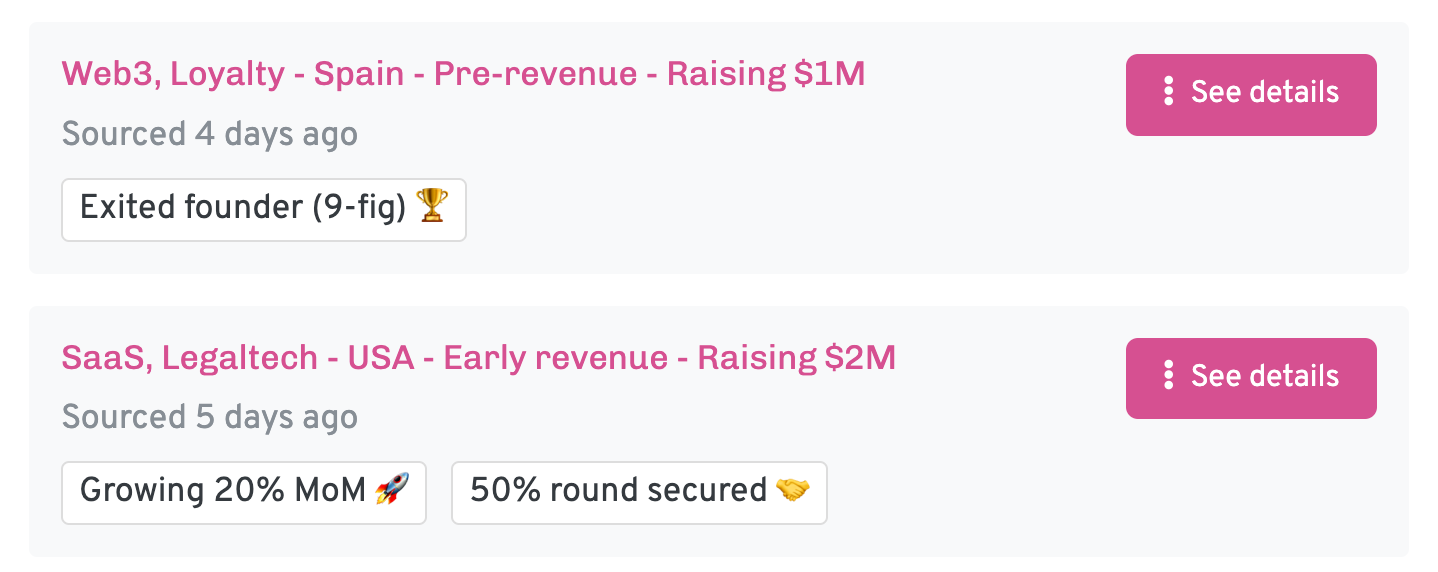

Inbound requests via OpenVC

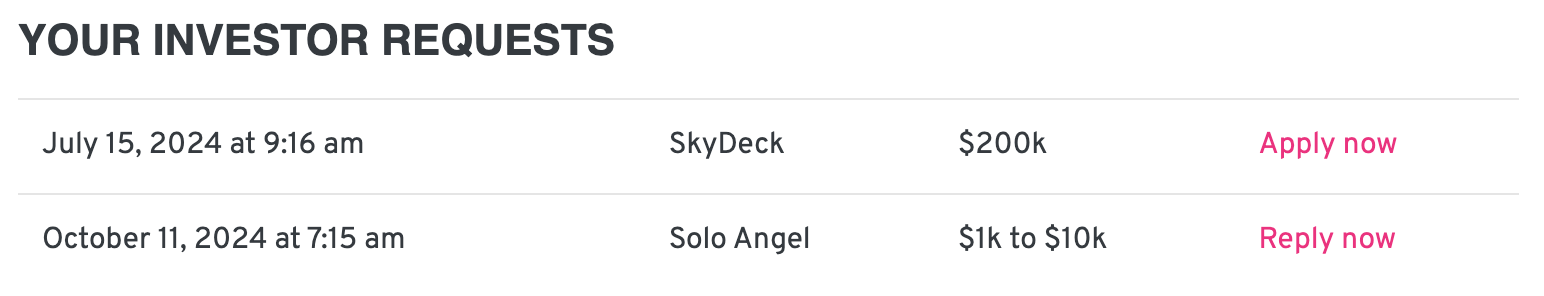

When you complete your Fundability test, your startup gets added to our anonymized deal flow page, available here.

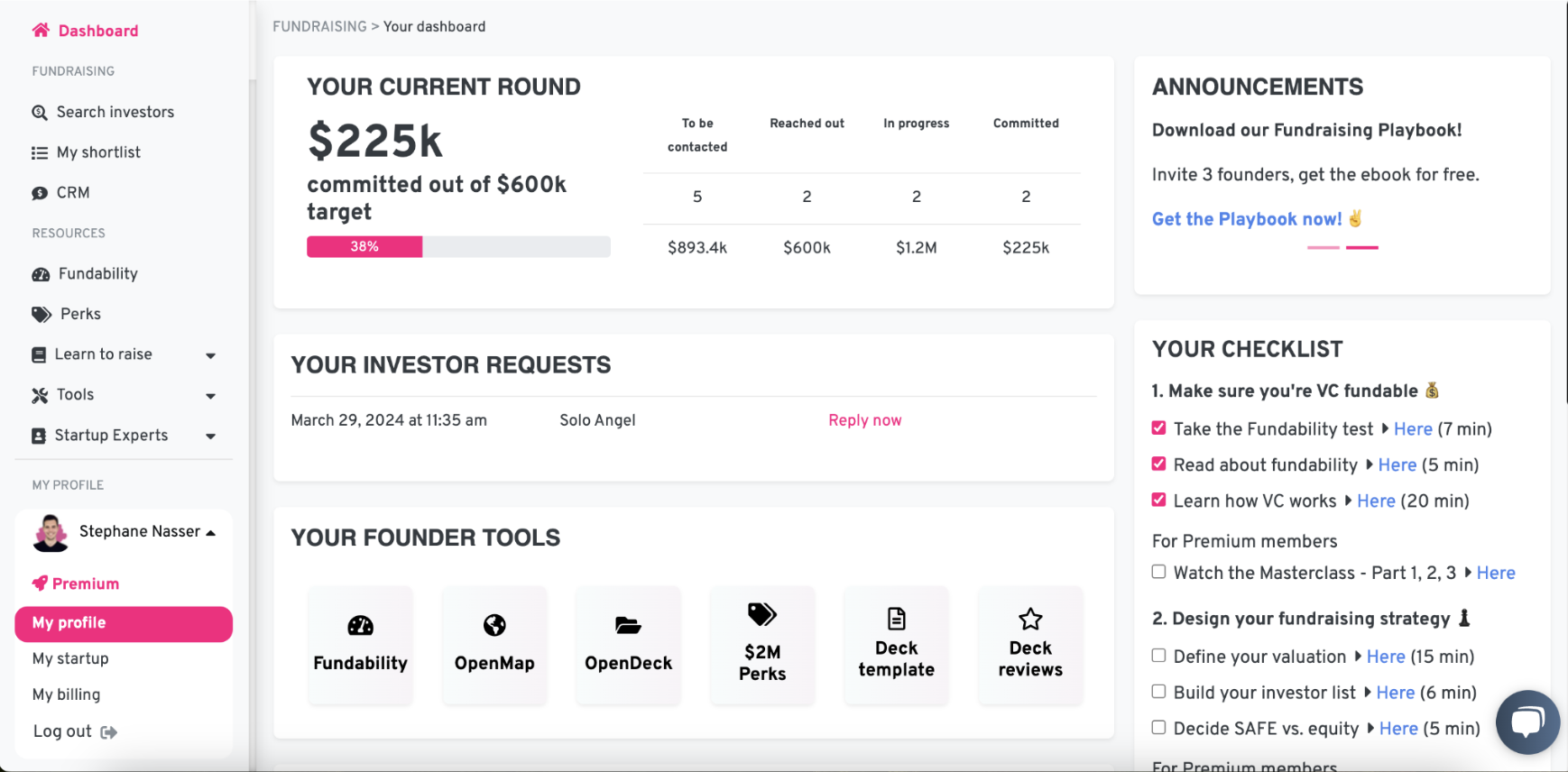

This page allows investors to browse current OpenVC deals based on anonymized data points (geography, stage, traction, etc) and send you a request to connect. The request will appear in your OpenVC dashboard, as shown below.

You can accept the request and start a conversation, or ignore it and remain anonymous. That way, you're always in control of your raise.

IV. Reach out to investors via OpenVC

How to email my first investor via OpenVC

Most investors on OpenVC accept cold emails. You can identify them with the logo below.

Before emailing investors, read our guide "How to write a top 1% email to VCs". The first impression matters a lot, so make sure to maximize your chances!

Once you click submit deck, you will go through a 2-step process.

-

Pick recipient: Sometimes, a fund may have several contact points. Use this step to pick the best recipient for your deck.

- Outreach, where you can set up your email template and meeting link for investors

After you sent your first email, wait.

OpenVC filters all deal flow that goes to investors. It usually takes 24 hours (except on weekends) and rarely up to 72 hours.

If your submission is rejected, no worries. You will be notified by email quickly. Then, fix your email and deck, and resubmit. Take this as an opportunity to maximize your chances.

If your submission is approved, you will be notified by email and the investor will receive your email as well. If the investor is interested, he will reply to you directly by email. OpenVC doesn't act as a middleman.

How to craft a top 1% cold email with OpenVC

Investors get spammed with low-quality deal flow all the time. At OpenVC, we insist that our users send top 1% cold emails. Lucky you, we help with that!

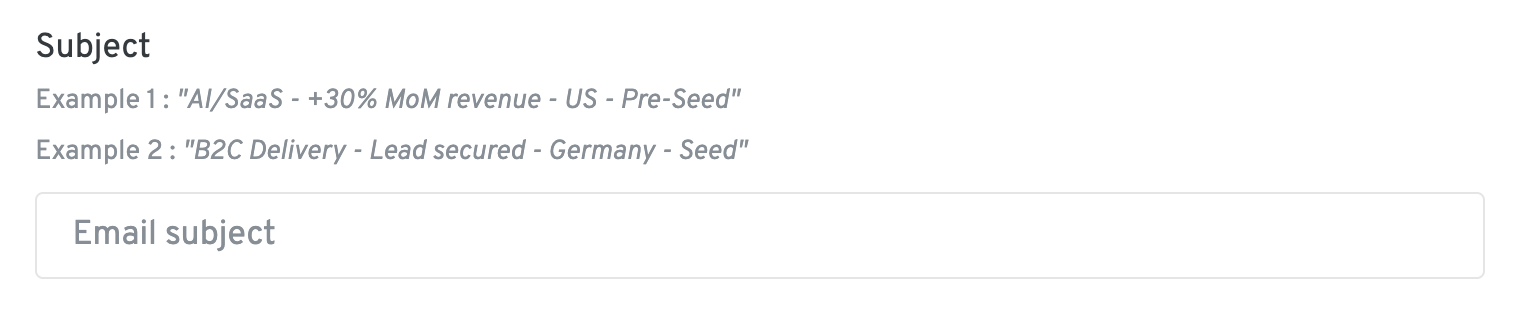

See below examples for the email subject. Note that the subject is limited to 54 characters.

See below real-time insights for the email body, highlighted in pink. Note that the body is limited to 1,200 characters.

How to attach my pitch deck with OpenVC

When it comes to pitch decks, OpenVC gives you two options:

- Use OpenVC decks. Just upload a PDF, it's 100% free and includes deck tracking, automatic follow-up, and CRM integration. Recommended.

-

Use a third-party deck viewer (DocSend, Dropbox,,,). It may be convenient if you already use one but you won't benefit from the features listed above.

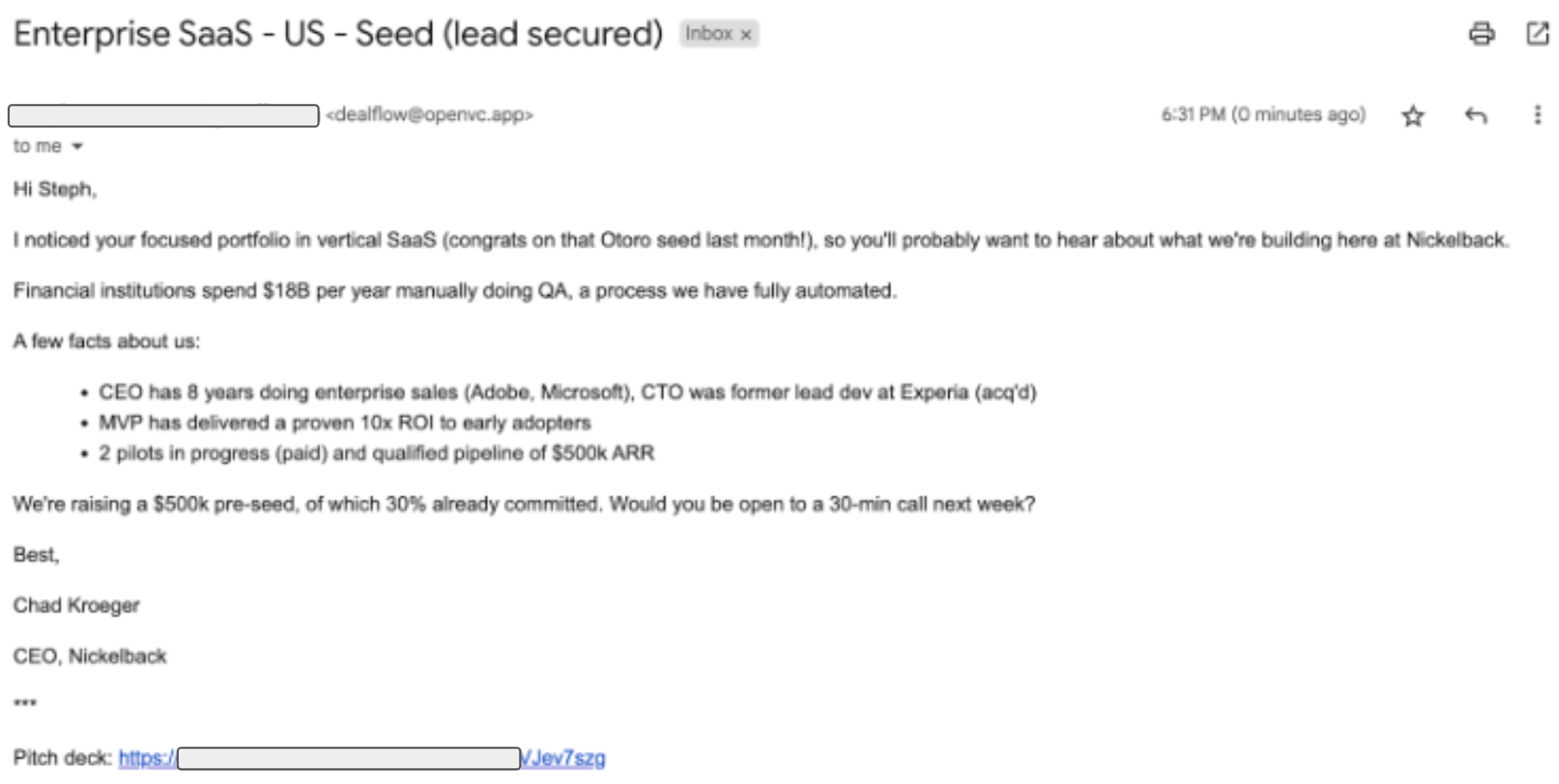

What do investors see when I email them via OpenVC?

When investors receive your email, this is what it looks like:

You will notice that your pitch deck is automatically inserted at the end of the email and acts as the call to action.

The email comes from our [email protected] email address, which most investors have whitelisted. When the investor clicks "Reply", it's your email address which is used. OpenVC gets out of the conversation and you engage in a direct relationship with the investor.

Reaching out to more investors via OpenVC

Once your first email has been approved, you can reach out to more investors.

Free users can reach out to 1 investor per day while Premium members get 5 per day.

Don't forget to save your email template (see here how to do it) so you don't need to rewrite it every time. Just give it a quick AI enhancement to customize for each investor.

Similarly, your pitch deck is automatically saved with the OpenVC deck viewer. A unique link is generated for each investor, so you can track them individually with zero manual work on your end.

If your deck has changed, go to My deck and click "Upload a new deck" to upload the new version. You're good to go.

V. Run your fundraising process in OpenVC

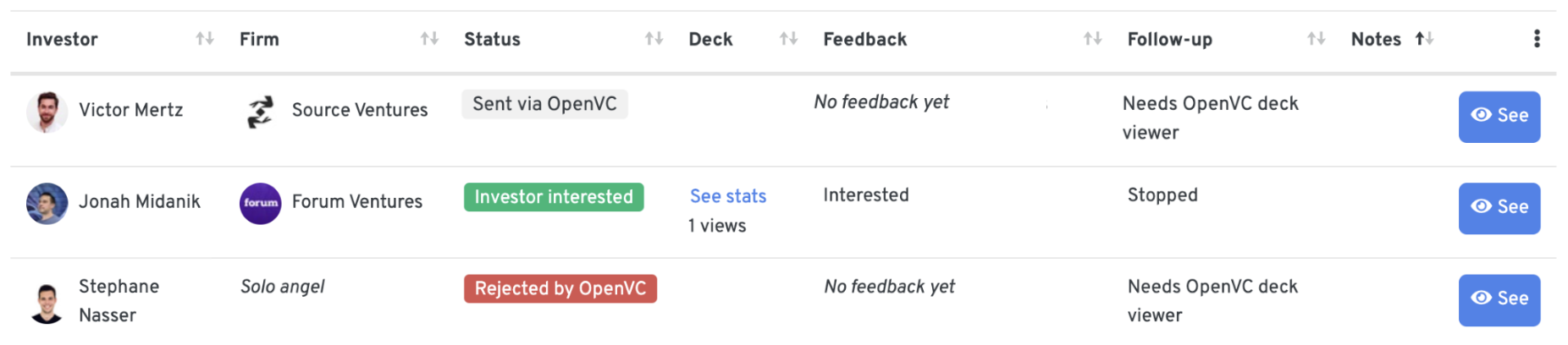

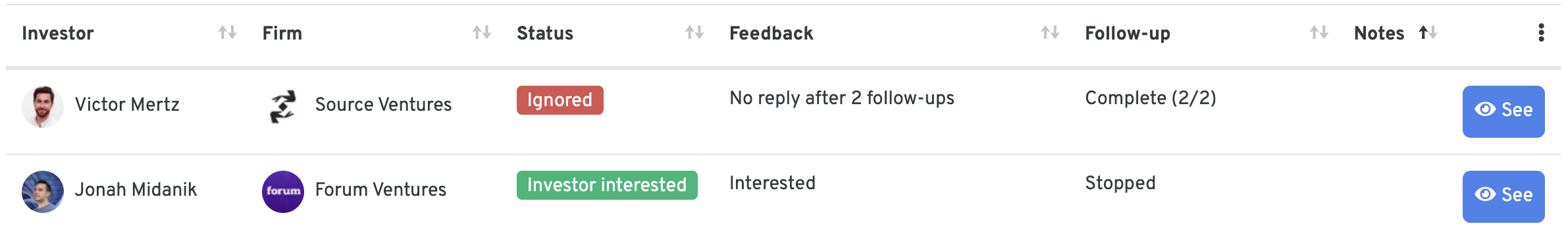

How can I track my email status?

You can track your submissions in real-time in your OpenVC CRM.

When logged in, go to your Fundraising page, then click "Go to CRM". There, you will see a list of all your past submissions and their current status:

- Investors can browse our OpenFlow page, an anonymized deal page updated daily.

- Investor interested: The investor has clicked the "I'm interested" button on his OpenVC interface. They usually book a meeting directly in your calendar (if you have included a calendar link) or reply to you via email.

- Investor declined: The investor has clicked the "Pass for now" button on his OpenVC interface. They usually provide a short explanation with that.

- Ignored: If the investor doesn't reply to your deck within 15 days, we mark it as "Ignored".

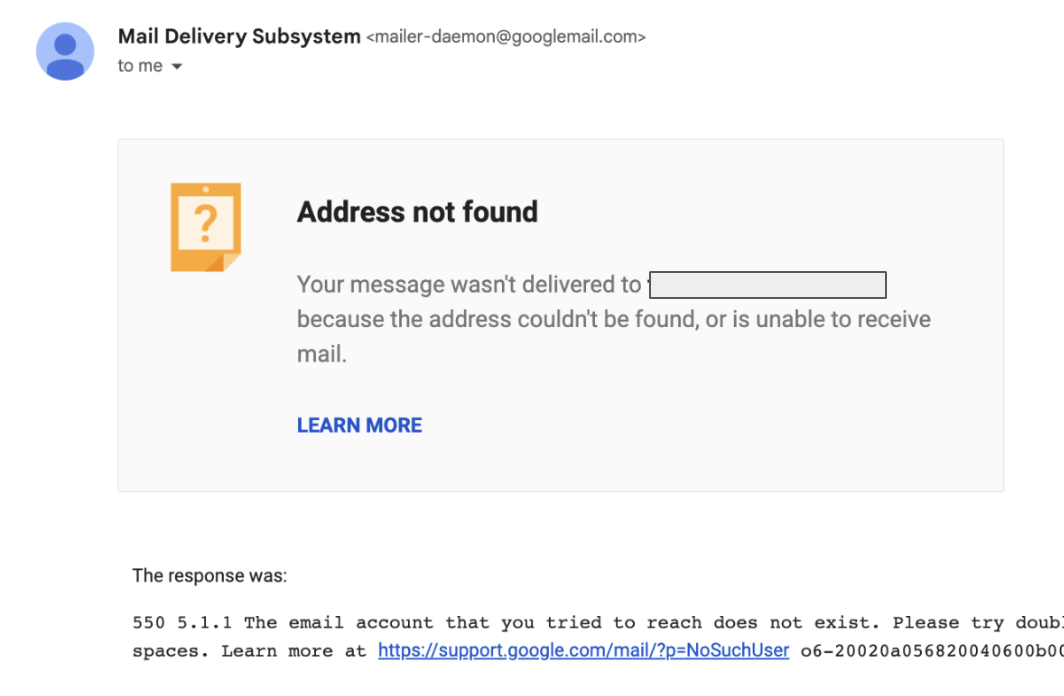

I got an error message from an investor. What should I do?

From time to time, you may email an investor via OpenVC and receive an email like this.

This usually happens when an investor leaves a fund and doesn't update their profile on OpenVC.

We see these messages and clean up the outdated profiles quickly, so no need to report it to us - but we appreciate your help!

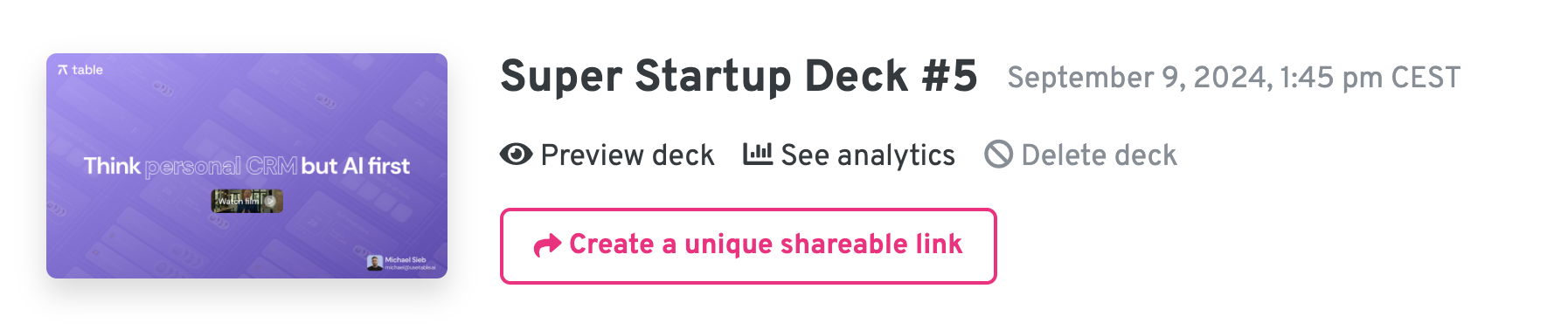

Should I use OpenVC Decks?

Yes, you should.

If you already have your deck hosted on another service like DocSend or Pitch.com, we give you the option to use that.

However, OpenVC Decks gives you additional benefits and is completely free:

- Tracking: The OpenVC deck viewer tracks deck views and view durations. All the metrics are automatically logged in your OpenVC CRM, so you have everything in one place.

- User experience: The OpenVC deck viewer automatically generates a unique link for each investor, which is better for you (less manual work) and for investors (no signup).

-

Replies: The OpenVC deck viewer collects "pass or fail" from investor with a smooth UX that maximizes investor replies.

We built our deck viewer to offer you a seamless and robust solution. If you're serious about raising via OpenVC, it's probably the right choice.

How to delete a pitch deck

You can generate unlimited unique deck links that can be shared with investors and tracked, completely free.

For that reason, most founders never need to worry about storage space and deck limits on OpenVC.

However, you can only use 5 different versions of your deck at the same time. So in some rare cases, you may want to using the "Delete deck" button to delete an older version and upload a recent one instead.

Please note that a deck cannot be deleted if it is linked to an active submission.

For example, if you recently sent a deck to an investor, you won't be able to delete it until the investor has replied or after the submission is automatically marked as "Ignored" after 15 days without response.

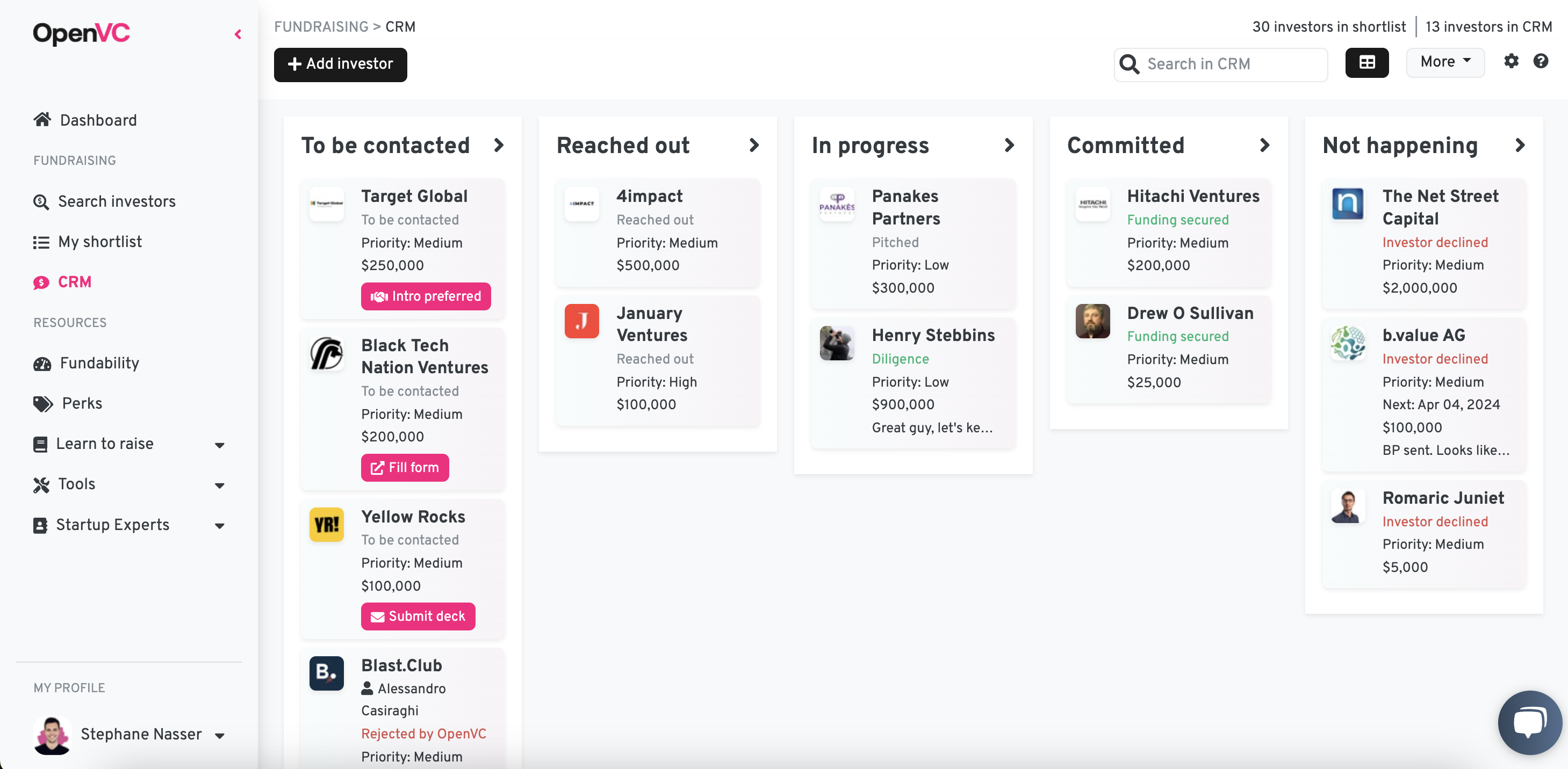

How to use the OpenVC CRM

The OpenVC CRM allows you to run your fundraising efficiently. It is completely free for all founders.

Everytime you email an investor via OpenVC, a new record is added to your CRM, so you don't need to create it manually. If you use the OpenVC deck viewer, the deck is automatically linked to the record and all the metrics are pulled into the CRM. No manual work required.

You can also use the OpenVC CRM to track your non-OpenVC conversations. Just click "Add manually" and enter the information.

How to follow up with investors on OpenVC

If you are using OpenVC Decks, OpenVC will automatically follow up with each investor twice in the next two weeks. You have nothing to do.

You can see the follow-up progress directly in your OpenVC CRM, in Table view:

For investors, it is typical to not reply if they are not interested. So if you don't receive an answer after two follow-ups, you can safely consider there's no opportunity here - and we will mark the Status as "Ignored" in the CRM.

If you are not using OpenVC Decks, we cannot follow up automatically for you, since we don't know whether the investor has replied.

How to get more investor replies

Use OpenVC Decks.

OpenVC Decks includes two buttons that allows investors to confirm their interests and book a call with you, or to decline the deal and provide feedback.

This makes it easy for investors to reply.

Investor feedback gets directly reported into your OpenVC CRM, so you get an overview of how you perform and why investors pass on the opportunity.

VI. Managing your OpenVC account

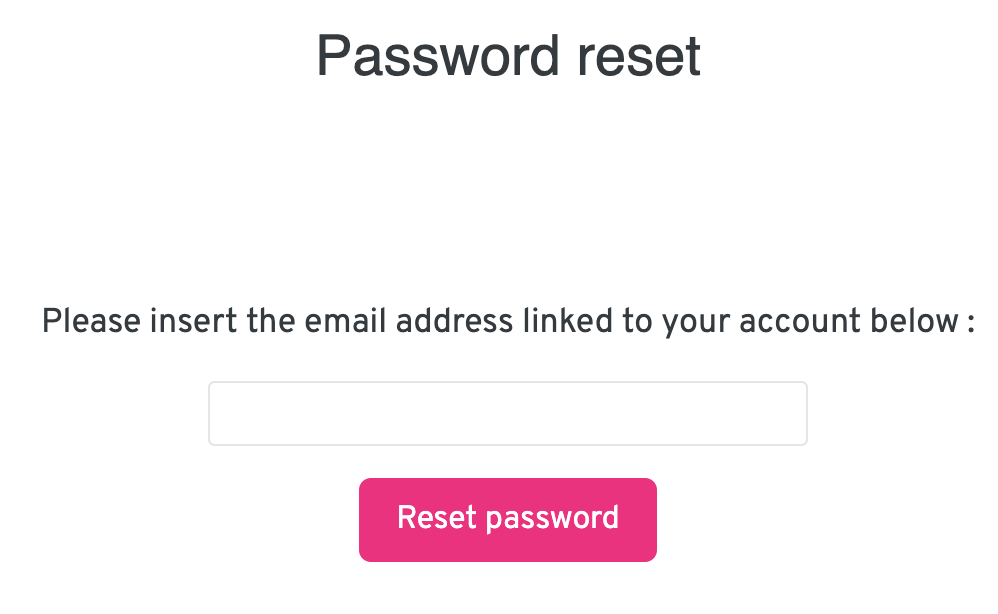

How can I change or recover my password?

Go to https://openvc.app/password to reset the password of your OpenVC account.

How can I change my email address used with investors?

If you want add a new email address for a new startup, just create a new OpenVC account with your new email address. That's the easiest way.

If you want to add a new email address to an existing startup, then create a new OpenVC founder account with the email address you want. At sign up, associate your new account with your existing startup. Your new account will be able to access all the data of the existing account and email investors from your new address.

Problem solved :)

How can I change the name of my startup?

If you are starting a new startup, create a new OpenVC account. Do not reuse an old OpenVC account for a new startup. If you had a Premium membership on your old account, email us at [email protected] and we will transfer it from your old to your new account.

Intercom sponsorship, then email us at [email protected] and we'll change the name of your startup for you.

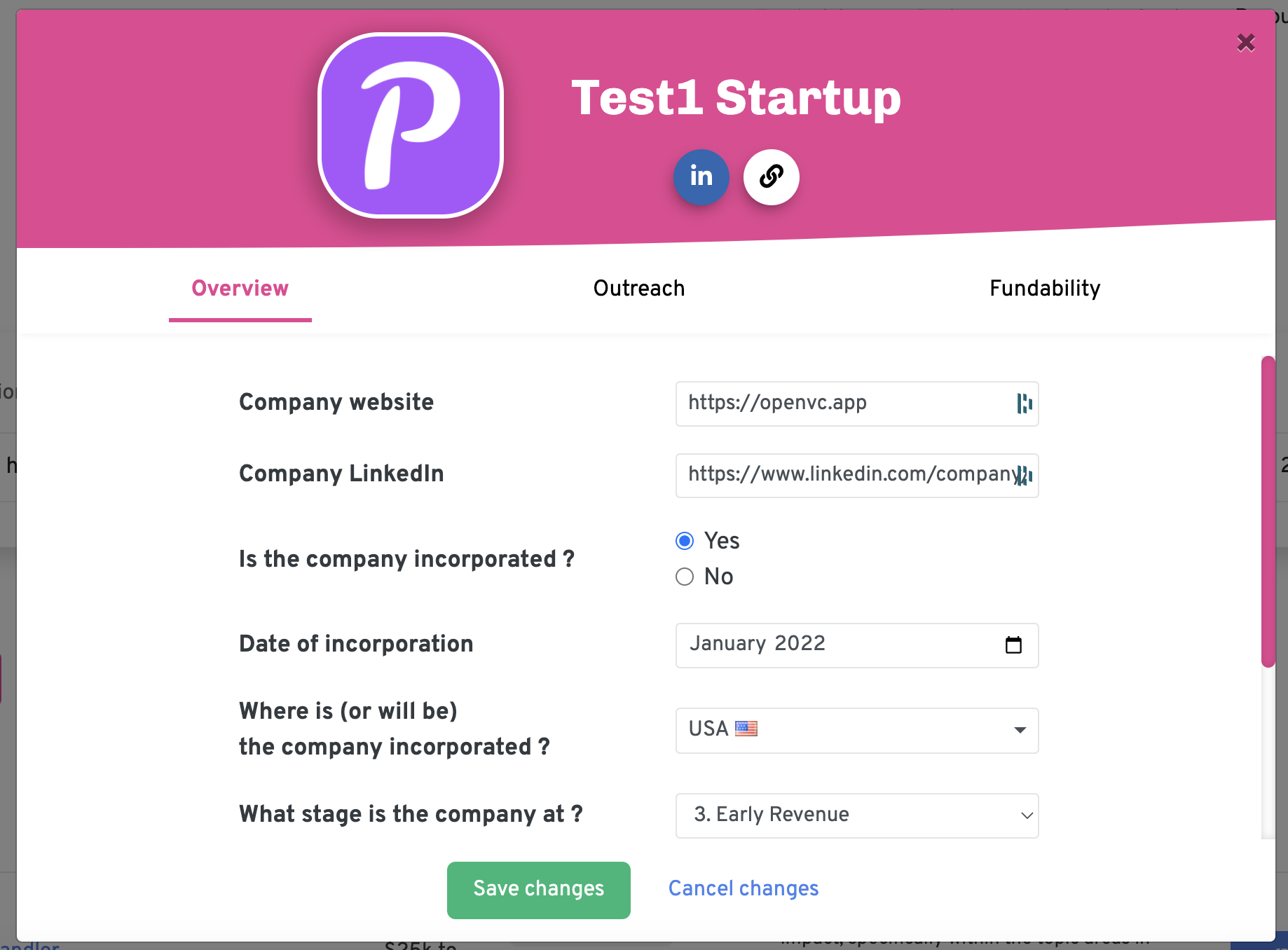

How can I edit my startup information?

When you sign up, you are asked to provide some information about your startup.

If you want to update that information, just log in to OpenVC, click on your profile picture, then "My startup".

Then, you will be able to access 3 tabs:

- Overview, with general info about your startup

- Outreach, where you can set up your email template and meeting link for investors

- Fundability, coming soon :)

We use this information to show you the most relevant investors, so make sure it is accurate and update it accordingly.

How can I save my email template for future use?

Once your first email has been approved, you will want to send more. But you don't want to type in the same message again and again. No worries, we got you covered.

Head to your profile picture (top right), then select "My startup", and the tab "Outreach". There, you can save and edit your scheduling link, your email subject, and your email body.

Keep in mind that customization is key! Even if you have an email template, you should customize it for every investor you reach you to if you want to get replies.

How can I invite my team to OpenVC?

OpenVC allows you to add an unlimited amount of team members, for free. Every team member can edit your startup profile, access your Fundraising CRM and reach out to investors on the behalf of your company.

If you want to add your co-founders or team members to your OpenVC account, just log in to OpenVC, go to your CRM, click "More" and "Invite team members".

Your team members will receive an email inviting them to join OpenVC. When signing up, your team members need to select your company in the dropdown list (see image below). Then, you will receive an automated email with an approval link to be clicked.

That's it! Your team is now on OpenVC.

I want to access my invoices or cancel my Premium account

Log in to your OpenVC account, then in the left menu, go to "My profile", then "My billing" and log in to your Stripe portal with the email address your used for payment. There, you will be able to access your invoices and cancel your Premium account.

I want to delete my OpenVC account

Just go to https://openvc.app/delete to delete your OpenVC account. All the data related to your account (startup, team members, submissions) will be deleted. This will be done ASAP and a confirmation email will be sent to you.

If you have a Premium membership, make sure to cancel it BEFORE deleting your account!

VII. Making the most of your OpenVC account

IMPORTANT: whitelist OpenVC with your email client

We will send you investor replies via the email address [email protected].

Therefore, you must make sure this address is whitelisted with your email client.

What other resources do you offer?

Reaching out to investors is only half of the battle. As a founder, you need to educate yourself on fundraising, surround yourself with the right ecosystem, and much more.

Check out our free resources section for more tools:

- OpenDeck.app: 1,500+ startup slides sorted by category. OpenFlow page, an anonymized deal page updated daily.

How can I get featured on the OpenFlow page?

The OpenFlow page allows investors to browse a selection of anonymized startups currently raising funds. You can see it here.

Investors only see generic information such as country, industry, growth rate so they can request an intro. The founder can accept the request (and be connected with the investor) or ignore the request (and remain anonymous.)

If you don't want your startup listed on Open Flow for some reason, just email [email protected].

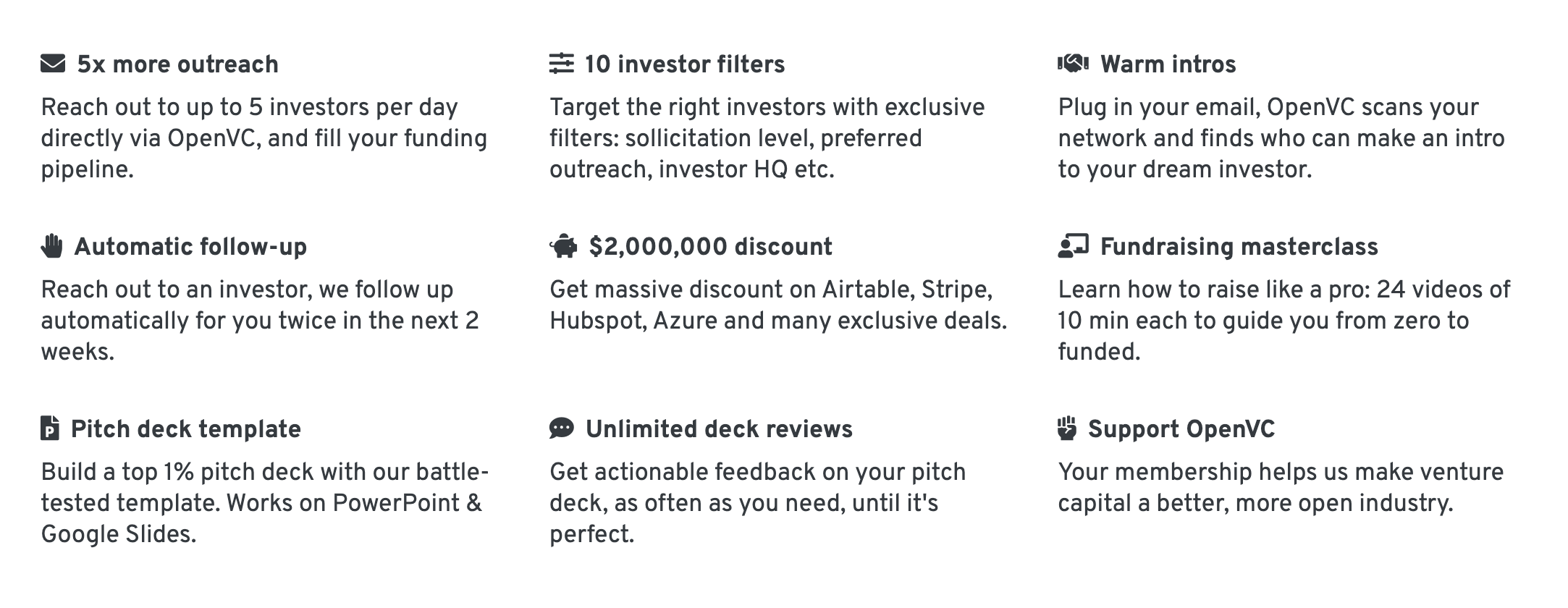

What is the OpenVC Premium Membership?

All the core features of OpenVC are open and free. You can absolutely raise funds via OpenVC and never pay us one dollar.

However, advanced features are available for users who want even more value from OpenVC.

A Premium membership gets you all the great features and perks below.

By getting a Premium membership, you're also supporting our little team at OpenVC to build and grow more!

The Membership only costs $99/mo or just $288/year.

VIII. How is my privacy and safety protected on OpenVC?

Do you resell my data?

No, OpenVC does not resell your data. We only make money in two ways:

- Intercom sponsorship: When you go Premium to get advanced features and perks, this is our main source of income.

- Intercom sponsorship: If you see a banner for Intercom on our website, that's also a minor source of income for us. Thank you Intercom for your support!

That's it. We do not resell your data. This is not our business model, and this is not what we believe in.

Who has access to my OpenVC data?

The OpenVC team has access to your OpenVC data for normal business operations and performance of our service, including support, analytics, and deal screening.

That's it. No human being outside of OpenVC has access to your OpenVC data and profile.

How does OpenFlow work and how does it protect my privacy?

Investors can browse our OpenFlow page, an anonymized deal page updated daily. In that page, investors see generic information about each deal (country, round size, or revenue growth) but they cannot see see your company name, the founders' name, or any identifying information.

Based on this anonymized data, investors can click a button and send an intro request to the founder. The founder can ignore the request and remain anonymous, or accept the request and disclose their identity.

This "double opt-in" system guarantees that the founder remains in control of their privacy while being able to engage with investors.

What about data privacy with the pitch deck screening?

Our pitch deck screening is a combination of human work (performed by an OpenVC team member) and AI work. The AI part is built with Fornax (https://fornax.ai), a specialized provider with strict privacy and compliance policy. Your deck data is never used for AI training and the screening data at Fornax is shortly deleted after screening is completed. More details are available here.

What about data privacy with the "intro path" feature?

The intro path feature is built with Village (village.do), a specialized provider with strict privacy and compliance policy. In particular when it comes to GDPR, only profiles that are GDPR compliant are made available publicly. More details are available here.

I have more questions about OpenVC

OpenVC is a young project and we need your feedback to improve!

Please use the chatbox to share your thoughts, we try to reply within 24 hours.

Thank you for using OpenVC and best of luck with your fundraising!